Health insurance is essential for individuals and families in California, offering financial protection and access to quality healthcare. This guide provides an overview of health insurance in the state.

What is Health Insurance?

Health insurance is a system designed to protect you from high medical costs. By paying regular premiums, you gain access to a pool of funds that cover your healthcare expenses.

Primary Purpose of Health Insurance

The main goal of health insurance is to reduce the financial burden of unexpected medical costs. It ensures you have access to healthcare services without facing overwhelming expenses in case of illness, injury, or emergencies.

How Does Health Insurance Work?

Health insurance spreads the risk of medical expenses across many people. You pay premiums to the insurance company, which uses these funds to cover the medical costs of its members.

When you need medical care, you submit a claim to your insurance provider for payment or reimbursement.

Risk Pooling

Risk pooling means that the financial risk of medical expenses is shared among a large group. Healthy individuals’ premiums help cover the costs for those who need medical treatment.

This system ensures no single person faces excessive financial strain from healthcare costs.

Coverage for Medical Expenses

Health insurance usually covers a variety of medical expenses, including:

- Doctor Visits: Regular consultations and check-ups.

- Hospitalization: Inpatient care and hospital stays.

- Prescription Medications: Necessary drugs prescribed by doctors.

- Diagnostic Tests: Lab services and tests like X-rays and blood work.

- Preventive Care: Services like vaccinations and health screenings to prevent illness.

Learn also about International Travel Insurance

Types of Health Insurance Plans

Health insurance plans vary in coverage, provider networks, and cost-sharing arrangements.

Understanding these differences is key to selecting the right plan. Here are the most common types of health insurance plans:

Health Maintenance Organization (HMO)

- Primary Care Physician (PCP): Members must choose a PCP from a network of providers.

- Referrals: Referrals from the PCP are required to see specialists or receive certain medical services.

- Cost: Lower premiums and out-of-pocket costs compared to other plans.

- Network Restrictions: Limited access to out-of-network providers, except in emergencies or with prior authorization.

Preferred Provider Organization (PPO)

- Flexibility: Members can choose healthcare providers without needing referrals from a PCP.

- Network: Care can be received from both in-network and out-of-network providers, though out-of-network care costs more.

- Cost: Higher premiums and out-of-pocket costs than HMOs, but with more freedom to choose providers.

Exclusive Provider Organization (EPO)

- Primary Care Provider: Similar to HMOs, members typically select a primary care provider.

- Specialist Access: Referrals are not usually required to see specialists.

- Cost: Lower premiums and out-of-pocket costs, but coverage is restricted to in-network providers.

High Deductible Health Plan (HDHP) paired with Health Savings Account (HSA)

- Deductibles: Higher deductibles but often lower premiums than traditional plans.

- Health Savings Account: HSAs are tax-advantaged accounts used for qualified medical expenses.

- Tax Benefits: Contributions are tax-deductible, and funds can roll over year to year.

- Control: Offers more control over healthcare spending and potential tax savings.

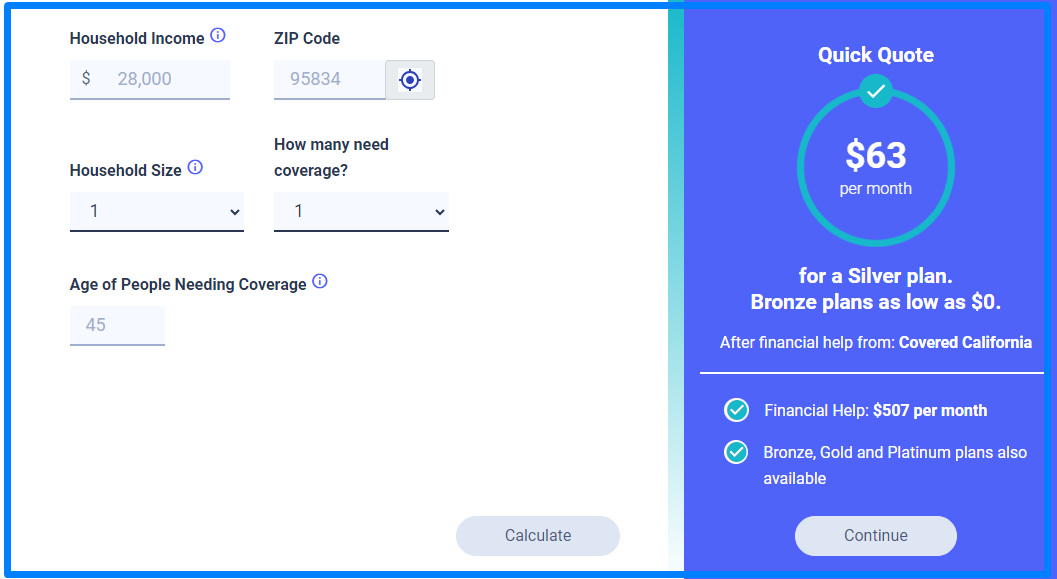

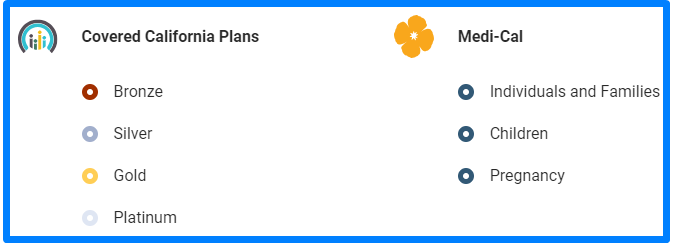

Health Insurance Marketplace in California

Covered California is the state’s health insurance marketplace, created under the Affordable Care Act (ACA) to help Californians find affordable health insurance.

Overview of Covered California

- Purpose: A platform for individuals and families to compare and buy health insurance plans.

- Plans Offered: Includes HMOs, PPOs, and EPOs with different coverage levels and costs.

- Ease of Use: A streamlined process to help consumers find and enroll in suitable plans.

Enrollment Periods and Special Enrollment Opportunities

- Open Enrollment: An annual period when anyone can sign up for health insurance.

- Special Enrollment: Available for individuals who have life events like marriage, childbirth, loss of other coverage, or moving.

Subsidies and Financial Assistance

- Premium Assistance: Financial help to lower monthly premiums based on income and family size.

- Cost-sharing Reductions: Lowers out-of-pocket costs for those who qualify, covering deductibles, copayments, and coinsurance.

How to Apply for Coverage through Covered California?

Applying for health insurance through Covered California is a straightforward process. Follow these steps to apply for coverage:

Visit the Covered California Website

- Go to the official Covered California website.

Create an Account

- Click on the ‘Sign In’ button and select ‘Create an Account.’

- Provide your personal information, including your name, email address, and phone number.

- Set up a username and password.

Complete the Application

- Log in to your account and start a new application.

- Enter details about your household, including the number of people, their ages, and income.

- Provide information about any current health coverage.

Compare Plans

- Once your application is complete, you’ll see a list of available health plans.

- Compare the different options, including coverage details, premiums, and out-of-pocket costs.

- You can choose between different plan types, such as HMOs, PPOs, and EPOs.

Select a Plan

- After reviewing your options, select the health plan that best meets your needs and budget.

Enroll in a Plan

- Confirm your selection and complete the enrollment process.

- You will receive a confirmation email with details about your new health plan.

Pay Your First Premium

- To activate your coverage, make sure to pay your first month’s premium directly to the insurance company.

Receive Your Insurance Card

- Once your payment is processed, you will receive your insurance card by mail. This card is your proof of coverage.

Special Enrollment Periods

- If you’re applying outside the open enrollment period, ensure you qualify for a special enrollment period due to a life event like marriage, birth, or loss of other coverage.

Popular Health Insurance Companies in California

California offers a variety of health insurance companies, each providing different coverage options. Here are some of the most popular ones:

Kaiser Permanente

![]()

- Kaiser Permanente Provides both health insurance and medical services through its own network of hospitals, medical centers, and physicians.

- Focuses on preventive care and wellness programs.

Blue Shield of California

- Blue Shield Offers individual, family, employer-sponsored, and Medicare plans.

- Provides access to a wide network of healthcare providers statewide.

Anthem Blue Cross

- Anthem Offers a range of health plans for individuals, families, and employers.

- Has a large network of physicians, hospitals, and healthcare providers.

Health Net

- Health Net Provides HMO, PPO, and Medicare Advantage plans.

- Focuses on affordability, choice, and quality.

UnitedHealthcare

- UHC Offers individual, family, employer-sponsored, and Medicare plans.

- Extensive network of hospitals, physicians, and specialists.

Cigna

- Cigna Offers HMO, PPO, and high-deductible health plans, plus dental and vision insurance.

- Emphasizes preventive care and wellness programs.

Molina Healthcare

- Specializes in Medicaid and Medicare plans, plus marketplace plans for individuals and families.

- Focuses on serving low-income and underserved populations.

Oscar Health

- Oscar is Known for a technology-driven approach with a user-friendly online platform and telemedicine services.

- Offers individual and family plans with innovative features.

Western Health Advantage

- Provides personalized care with local provider networks.

- Offers HMO and PPO plans for individuals, families, and employer groups.

Sharp Health Plan

- Sharp Health Focuses on quality care and member satisfaction, primarily in the San Diego area.

- Offers HMO and PPO plans with access to Sharp HealthCare’s network.

Rights and Protections for Health Insurance Consumers

Health insurance consumers in California have several important rights and protections:

Access to Essential Health Benefits

- Coverage for vital services like preventive care, prescription drugs, maternity care, mental health services, and emergency care.

Coverage for Preventive Services

- Health plans cover preventive services such as vaccinations, screenings, and wellness exams at no extra cost.

Transparency and Disclosure

- Clear information about premiums, deductibles, network providers, and covered services to help you make informed choices.

Appeals and Grievance Procedures

- The right to challenge coverage denials or claim denials through a formal appeals process.

Non-Discrimination Protections

- Protection against discrimination based on race, ethnicity, religion, gender identity, or disability.

Continuation of Coverage

- Options to maintain coverage during job loss, changes in family status, or eligibility for other coverage.

Privacy and Confidentiality

- Strict adherence to privacy laws like HIPAA to safeguard your personal health information.

Factors to Consider When Choosing a Health Insurance Plan

Choosing the right health insurance plan is crucial for your healthcare access and financial well-being. Here are key factors to consider:

- Ensure your preferred doctors and medical facilities are included in the plan’s network to avoid extra costs.

- Evaluate premiums (monthly payments), deductibles (amount you pay before insurance kicks in), and out-of-pocket expenses (co-pays, co-insurance) to find an affordable plan.

- Review what services are covered, such as preventive care, hospital visits, and additional benefits like telemedicine.

- Make sure your medications are covered and affordable under the plan’s prescription drug benefits.

- Research the plan’s quality ratings and customer reviews to gauge the level of care and service you will receive.

- Assess how easy it is to access care and manage your healthcare needs through online tools, customer service, and provider availability.

- Confirm coverage for any specialized treatments or services you may need now or in the future.

- Consider your potential future health needs and how the plan will impact your finances over time.

FAQs about Health Insurance in California

Here are some frequently asked questions and answers about Health Insurance in California.

How to Enroll in Health Insurance through Covered California?

Enrolling in health insurance through Covered California is simple and can be done online, by phone, or with the help of certified enrollment counselors or insurance agents.

What Financial Assistance Programs are Available?

Covered California offers premium assistance and cost-sharing reductions to eligible individuals and families. These programs, based on income and household size, significantly lower monthly premiums and out-of-pocket costs.

Can I Keep My Current Doctor?

Whether you can keep your current doctor depends on the specific health insurance plan you choose. Before enrolling, check the plan’s provider network to see if your preferred doctors and healthcare facilities are included.

What If I Lose Employer-Sponsored Coverage?

If you lose your job and employer-sponsored health insurance coverage, you may qualify for COBRA continuation coverage.

What If I Have a Dispute with My Insurance Company?

If you have a dispute with your health insurance company, you can file an appeal or grievance to challenge their decision. Contact your insurer to initiate the appeals process.

If the issue remains unresolved, you can file a complaint with the California Department of Insurance or the Department of Managed Health Care.

Final Words

Navigating the world of health insurance can be complex, but it’s essential to ensure you have the coverage you need to protect your health and financial well-being.

By understanding the various options available through Covered California and considering factors such as network coverage, cost, benefits, and quality of care, you can make an informed decision when selecting a health insurance plan.