Individual Income Tax USA for 2024 – In the ever-evolving landscape of personal finance and taxation, understanding the intricacies of Individual Income Tax USA and households alike.

Income tax, a cornerstone of government revenue and fiscal policy, affects every taxpayer, shaping financial decisions and impacting economic well-being.

What is Personal Income Tax in the USA?

Personal income tax is a form of taxation imposed by a state or other governmental entity on an individual’s earnings.

Among the 50 states and Washington, D.C., only seven opt not to impose a personal income tax.

The tax rates can vary significantly from one state to another, with some utilizing a flat rate for tax calculations, while most employ a bracket system that adjusts the tax rate based on an individual’s income.

Personal income taxes play a pivotal role in generating revenue for states, constituting approximately one-third of the total tax revenue they collect.

Over the years, personal income tax revenue has gained increasing significance in state finances. In 1950, personal income tax accounted for approximately 9.3 percent of all state tax revenue.

By 1970, this figure had risen to 19 percent, and as of 2010, it had expanded even further to reach 33.5 percent.

Individual Income Tax Rate and Tax Brackets USA in 2024

In the realm of individual income tax for the year 2024, the top tax rate stands at 37%, a rate that applies to most income sources.

It’s worth mentioning that the Tax Cuts and Jobs Act (P.L. 115-97) brought about significant changes to the landscape of individual taxation, including reductions in the tax rates and a simplification of the number of tax brackets.

It’s important to be aware that P.L. 115-97 included provisions that are set to sunset after the year 2025.

These provisions, which include the lower tax rates and the revised tax brackets, were designed to adhere to the budget rules of the United States Senate.

Income Tax Rate and Tax Brackets for Single Filers

For the year 2024, the tax brackets for single filers are delineated as follows:

- A 10% tax rate is applied to taxable incomes ranging from $0 to $11,000, with a tax owed equivalent to 10% of the taxable income within this bracket.

- For taxable incomes in the range of $11,001 to $44,725, a 12% tax rate is levied. In this case, the tax owed comprises $1,100 plus 12% of the amount exceeding the $11,000 threshold.

- Taxable incomes spanning from $44,726 to $95,375 are subject to a 22% tax rate. The tax owed within this bracket is calculated as $5,147 plus 22% of the income exceeding $44,725.

- In the bracket encompassing $95,376 to $182,100, a 24% tax rate prevails. The tax owed in this range includes $16,290 plus 24% of the income surpassing the $95,375 threshold.

- For taxable incomes between $182,101 and $231,250, a 32% tax rate is applicable. The tax owed consists of $37,104 plus 32% of the amount exceeding $182,100.

- In the income range of $231,251 to $578,125, a 35% tax rate is imposed. The tax owed is calculated as $52,832 plus 35% of the income exceeding $231,250.

- Finally, for those with taxable incomes amounting to $578,126 or more, a 37% tax rate applies. The tax owed in this highest bracket is determined as $174,238.25 plus 37% of the income exceeding $578,125.

You can visit also- Income Tax Login USA

Income Tax Rate and Tax Brackets for Married, Filing Jointly

For the fiscal year 2024, the tax brackets for married couples filing jointly manifest in the following manner:

- A 10% tax rate embraces taxable incomes ranging from $0 to $22,000, with the corresponding tax owed equaling 10% of the taxable income within this particular bracket.

- For incomes between $22,001 and $89,450, a 12% tax rate is imposed. In this case, the tax liability encompasses $2,200 plus 12% of the income exceeding the $22,000 threshold.

- Taxable incomes within the span of $89,451 to $190,750 are subject to a 22% tax rate. The tax owed within this bracket is computed as $10,294 plus 22% of the income exceeding $89,450.

- In the bracket encompassing $190,751 to $364,200, a 24% tax rate takes precedence. The tax owed within this range comprises $32,580 plus 24% of the income exceeding $190,750.

- For taxable incomes ranging from $364,201 to $462,500, a 32% tax rate prevails. The tax liability in this segment includes $74,208 plus 32% of the income exceeding $364,200.

- In the income range of $462,501 to $693,750, a 35% tax rate is applied. The tax owed is calculated as $105,664 plus 35% of the income exceeding $462,500.

- Finally, for those with taxable incomes totaling $693,751 or more, a 37% tax rate comes into play. The tax owed in this highest bracket is determined as $186,601.50 plus 37% of the income exceeding $693,750.

Income Tax Rate and Tax Brackets for Married, Filing Separately

For the fiscal year 2024, the tax brackets for married individuals filing separately unfold as follows:

- A 10% tax rate is extended to taxable incomes spanning from $0 to $11,000, with the tax owed equivalent to 10% of the taxable income within this bracket.

- For incomes ranging from $11,001 to $44,725, a 12% tax rate takes effect. In this scenario, the tax liability encompasses $1,100 plus 12% of the income exceeding the $11,000 threshold.

- Taxable incomes within the span of $44,726 to $95,375 are subject to a 22% tax rate. The tax owed within this bracket is calculated as $5,147 plus 22% of the income exceeding $44,725.

- In the bracket spanning from $95,376 to $182,100, a 24% tax rate prevails. The tax liability within this range comprises $16,290 plus 24% of the income exceeding $95,375.

- For taxable incomes between $182,101 and $231,250, a 32% tax rate is applied. The tax owed in this segment includes $37,104 plus 32% of the income exceeding $182,100.

- In the income range of $231,251 to $346,875, a 35% tax rate is imposed. The tax liability is calculated as $52,832 plus 35% of the income exceeding $231,250.

- Finally, for individuals with taxable incomes totaling $346,876 or more, a 37% tax rate is invoked. The tax owed in this highest bracket is determined as $93,300.75 plus 37% of the income exceeding $346,875.

Income Tax Rate and Tax Brackets for Head of Household

For the fiscal year 2024, the tax brackets for heads of households unfold as follows:

- A 10% tax rate applies to taxable incomes spanning from $0 to $15,700, with the tax owed equaling 10% of the taxable income within this specific bracket.

- For incomes ranging from $15,701 to $59,850, a 12% tax rate takes effect. In this scenario, the tax liability comprises $1,570 plus 12% of the income exceeding the $15,700 threshold.

- Taxable incomes within the span of $59,851 to $95,350 are subject to a 22% tax rate. The tax owed within this bracket is calculated as $6,868 plus 22% of the income exceeding $59,850.

- In the bracket extending from $95,351 to $182,100, a 24% tax rate prevails. The tax liability within this range encompasses $14,678 plus 24% of the income exceeding $95,350.

- For taxable incomes between $182,101 and $231,250, a 32% tax rate is invoked. The tax owed in this segment includes $35,498 plus 32% of the income exceeding $182,100.

- In the income range of $231,251 to $578,100, a 35% tax rate is imposed. The tax liability is calculated as $51,226 plus 35% of the income exceeding $231,250.

- Finally, for those with taxable incomes totaling $578,101 or more, a 37% tax rate comes into play. The tax owed in this highest bracket is determined as $172,623.50 plus 37% of the income exceeding $578,100.

How to Calculate Individual Income Tax USA?

Follow the calculating method for individual income tax in the USA with an example.

Assumptions

- Resident alien husband and wife with two children (ages 7 and 9), all eligible for the child tax credit

- One spouse earns all the income, which is entirely domestic (not foreign-source)

- A joint tax return is filed, and the Alternative Minimum Tax (AMT) liability is less than the regular tax liability.

Tax Computation:

Gross Income

- Salary: $150,000

- Interest: $18,500

- Long-term capital gain (on assets held for more than one year): $3,000

- Total Gross Income: $171,500

- Adjustments: None

Adjusted Gross Income (AGI): $171,500

Deductions

- Standard Deduction for a Married Filing Jointly return: ($27,700)

- Taxable Income: $143,800

Tax Calculation

- On taxable income of $140,800 (calculated as $143,800 minus the capital gain of $3,000) at joint-return tax rates: $21,591

- On the $3,000 capital gain at a special long-term capital gains tax rate of 15%: $450

- Total Tax Before Credits: $22,041

Credits

- Child Tax Credit: ($2,000 per child, multiplied by 2 children): ($4,000)

- Net Tax Owed: $18,041

In this sample calculation, a resident alien couple with two qualifying children earned a total gross income of $171,500 in 2024.

After taking deductions and calculating taxes at the applicable rates, their net tax liability for the year is $18,041. The Child Tax Credit helped reduce their tax burden by $4,000.

Income Tax Calculator USA

If you’re looking to estimate your income tax liability quickly and accurately, our Income Tax Calculator is a valuable tool for financial planning.

Simply visit the Income Tax Calculator Website to access the calculator, enter your financial details, and obtain a clear breakdown of your projected tax obligations based on current tax laws and rates.

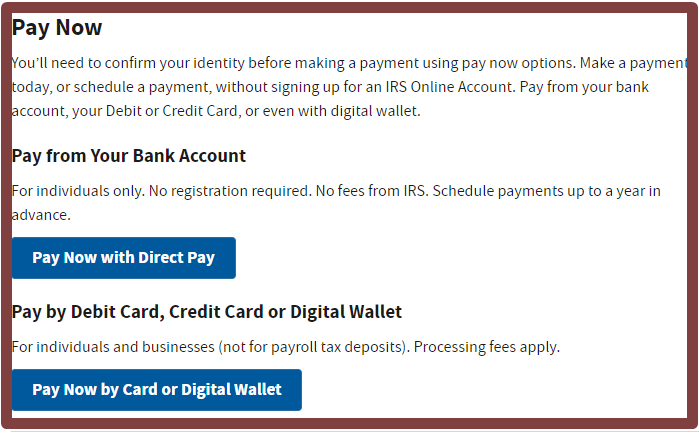

How to Pay Individual Income Tax USA?

Paying your income tax in the United States is a straightforward process, and the Internal Revenue Service (IRS) provides various methods to make it convenient for taxpayers.

To explore your payment options and access the necessary resources, you can visit the official IRS website.

Here, you’ll find comprehensive information on how to pay your income tax, whether it’s through electronic payment methods, mail, or in-person at authorized locations.

Understanding the Penalty for Not Filing Taxes

When you fail to file your income tax return with the IRS, penalties may apply based on the timing and amount of unpaid tax. Here’s what happens if you don’t file taxes:

Calculation of Penalty

The penalty is determined by the IRS considering the timing of your tax return submission and the amount of unpaid tax by the original payment due date.

Failure to File Penalty

- It’s 5% of the unpaid taxes for each month or part of a month that your tax return is late, up to a maximum of 25% of your total unpaid taxes.

- If you also owe taxes, both the Failure to File Penalty and Failure to Pay Penalty apply, resulting in a combined penalty of 5% per month.

- After 5 months, the Failure to File Penalty reaches its maximum limit, but the Failure to Pay Penalty continues to accumulate until the tax is fully paid.

Minimum Penalty

If your tax return is over 60 days late, there’s a minimum Failure to File Penalty, which varies by tax year.

Avoiding Failure-To-File Penalty

- File your income tax return by the due date or request an automatic six-month extension.

- Initiate a tax extension process by mailing Form 4868 to the IRS or settling the tax owed through various payment methods.

- Consider penalty abatement if you faced extraordinary circumstances or missed the deadline due to unforeseen events.

- Two common grounds for penalty relief are Reasonable Cause and First-Time Penalty Abatement.

- Reasonable Cause includes situations like natural disasters, severe illness, or the death of an immediate family member.

- First-Time Penalty Abatement is granted to taxpayers with a clean penalty record over the past three years.

Requesting Penalty Abatement

Contact the IRS through the toll-free number provided on your IRS notice or submit a written request using IRS Form 843 to initiate a penalty abatement request.

FAQs About Personal Income Tax in the USA

Here are some frequently asked questions and answers related to individual income tax USA.

What is the deadline for filing my federal income tax return?

Ans: The typical deadline for filing your federal income tax return is April 15th of each year. However, if the 15th falls on a weekend or holiday, the deadline may be extended to the next business day.

Can I request an extension if I can’t file my tax return by the deadline?

Ans: Yes, you can request an automatic six-month extension by filing IRS Form 4868.

This extends the deadline for filing your return but not for paying any taxes owed. Taxes must still be paid by the original due date to avoid penalties and interest.

How can I pay my federal income taxes?

Ans: You can pay your federal income taxes using various methods, including electronic payment options such as Direct Pay, Electronic Federal Tax Payment System (EFTPS), credit card, or check.

The IRS website provides detailed information on payment options.

What if I can’t afford to pay my taxes in full by the deadline?

Ans: If you can’t pay your taxes in full, it’s still essential to file your return on time to avoid the failure-to-file penalty.

You can explore options like setting up an installment agreement with the IRS to pay your taxes over time.

Are there any deductions or credits available to reduce my tax liability?

Ans: Yes, there are various deductions and tax credits available to reduce your tax liability. Common deductions include the standard deduction and itemized deductions like mortgage interest and charitable contributions.

Tax credits, such as the Child Tax Credit and Earned Income Tax Credit, can also lower your tax bill.

What are the consequences of not filing my tax return or paying my taxes on time?

Ans: Failing to file your tax return or pay taxes on time can result in penalties and interest charges.

The IRS may assess the Failure to File Penalty and Failure to Pay Penalty, which can significantly increase your overall tax debt.

How can I request penalty relief from the IRS?

Ans: If you have a valid reason for not filing or paying on time, you can request penalty relief. Common grounds for relief include reasonable cause (e.g., due to a medical emergency or natural disaster) and first-time penalty abatement (if you have a clean penalty record over the past three years).

You can contact the IRS or submit Form 843 with supporting documentation to request relief.

Final Words

In the complex landscape of personal finance and taxation, understanding the nuances of income tax is crucial for every taxpayer.

Whether you’re filing as an individual, a head of household, or part of a married couple, knowing the rules, deadlines, and available deductions and credits can help you navigate the tax season with confidence.

Remember that timely filing and payment are essential to avoid penalties, but there are options available, such as requesting extensions or exploring penalty abatement in certain situations.